Generative AI in insurance

There is a lot of buzz around Generative AI/Large Language models (LLM) due to ChatGPT, and in this article we will discuss some use cases in the insurance industry and some of the work we have done at acxhange. In this article we will use ChatGPT or LLM interchangeably.

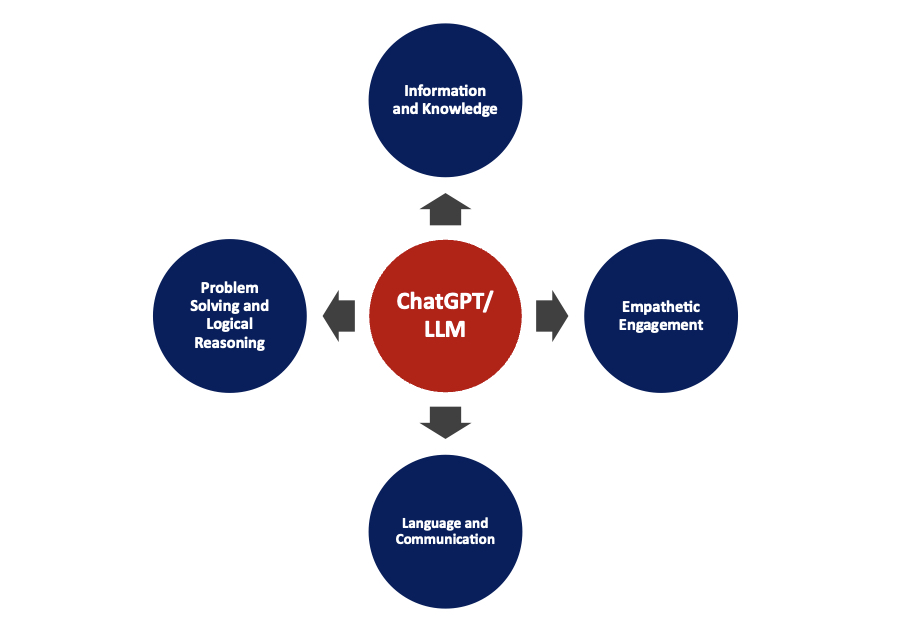

At a high level, ChatGPT (or LLM or Model) can help with the following broad areas.

Information and Knowledge: ChatGPT has been trained on a vast amount of information and can assist with answering questions, providing explanations, and offering insights across various subjects such as science, history, geography, technology, and more. ChatGPT can help you find specific details or offer general knowledge on a wide range of topics.

Language and Communication: ChatGPT can help with tasks related to language understanding, generation, and translation. Whether you need help in writing, proofreading, or coming up with creative ideas, ChatGPT can provide suggestions and guidance. ChatGPT can also help with grammar, vocabulary, and structuring sentences or documents.

Problem Solving and Logical Reasoning: ChatGPT can engage in logical reasoning, critical thinking, and problem-solving discussions. If you need assistance in analyzing a situation, exploring different perspectives, or evaluating potential solutions, ChatGPT can help guide you through the process.

Empathetic Engagement: While ChatGPT is an artificial intelligence and lack emotions, it can still offer support and engage in empathetic conversations. It can provide a listening ear, offer advice, and help you explore your thoughts and feelings. However, it’s important to note that It is not a substitute for professional help, and if you require assistance with serious emotional or mental health issues, it is recommended to reach out to a qualified human professional.

ChatGPT can be applied in various ways within the insurance industry to enhance customer service, streamline processes, and improve efficiency. Below few potential applications across insurance value chain.

Marketing and sales: ChatGPT can revolutionize marketing and sales in insurance by providing personalized customer interactions, automating lead generation & qualification, and help craft targeted campaigns. Its natural language processing capabilities enable tailored insurance recommendations and prompt responses to inquiries. Analyzing customer data helping identify upselling opportunities, while content creation and social media engagement can enhance brand reach. ChatGPT can be used to automate and streamline processes to boost customer engagement, and drive business growth in the insurance industry.

Customer Support: ChatGPT can be used as a virtual assistant to handle customer inquiries, provide information about policies and coverage, and assist with common customer service tasks. It can answer frequently asked questions, guide customers through claims processes, and offer support in a conversational manner, providing a more efficient and personalized customer experience.

Claims Processing: ChatGPT can help automate parts of the claims processing workflow. By analyzing claim details provided by customers, it can assist in gathering relevant information, verifying policy coverage, and estimating claim amounts. This can expedite the claims process and reduce the need for manual intervention, improving overall efficiency.

Underwriting and Risk Assessment: ChatGPT can assist underwriters by analyzing and interpreting data from insurance applications. It can help identify potential risks, assess policy eligibility, and provide recommendations based on historical data, policy guidelines, and industry regulations. This can streamline the underwriting process and improve decision-making.

Policy Management: ChatGPT can be utilized to manage policy-related inquiries, such as policy modifications, renewals, and cancellations. It can assist customers in understanding their policy terms and conditions, provide premium quotes, and guide them through policy management tasks. This helps enhance self-service capabilities and reduces the workload on customer service agents.

Information Technology: In the realm of Information Technology, ChatGPT proves invaluable for developers and testers, enabling code and script generation, aiding Technical Support with knowledge base creation, documentation, and streamlining routine IT Operations tasks.

It’s important to note that while ChatGPT can automate certain aspects of insurance processes, human oversight and intervention are still necessary, particularly for complex or sensitive situations. Additionally, data security and privacy should be maintained when utilizing AI technologies in the insurance industry.

Here at Acxhange, we have made significant strides in leveraging ChatGPT technology to develop cutting-edge solutions that are currently deployed in production. I am excited to share one such solution.

In the insurance industry, the need to efficiently handle a wide variety of inbound documents on a daily basis is paramount. These documents encompass policy applications, claims forms, supporting materials like medical records or police reports, endorsements, renewals, cancellations, and various other correspondences related to insurance policies. They can arrive via emails, emails with attachments, faxes (yes, they still exist!), and scanned documents. The ability to process these documents accurately and swiftly is crucial for insurers as it directly affects their capacity to deliver prompt and precise services to customers.

While OCR, RPA, and ML technologies have been employed to automate parts of the document processing pipeline, reducing errors and enhancing overall efficiency, a significant portion of the process still remains manual. Manual keying often leads to information loss, and even solutions using OCR, RPA, and ML have fallen short of fully eliminating the need for manual effort.

To address these challenges, we harnessed the capabilities of ChatGPT in language understanding, communication, problem-solving, and logical reasoning. The result is a robust solution that effectively tackles this problem with a higher degree of success. Our solution automates the processing of inbound documents and ensures data integrity, eliminating the loss of valuable information. Moreover, it extracts meaningful insights from these documents, leading to improved experiences for customers, intermediaries, partners, and employees.

By combining the power of ChatGPT with advanced document processing techniques, we have revolutionized the way insurers handle their inbound documents. Our solution enhances efficiency, accuracy, and customer satisfaction by streamlining operations, reducing manual effort, and enabling valuable insights from the data contained within the documents.

We are excited to bring this innovative solution to our clients and empower them to transform their document processing workflows for the better.

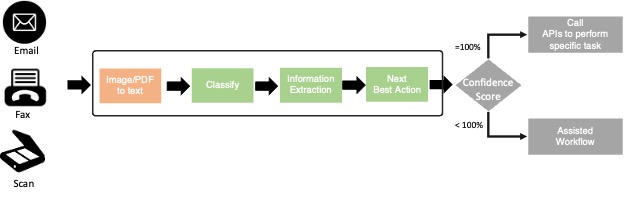

The architecture includes use of orchestration engine, and we leveraged Microsoft Azure OpenAI service for LLM capabilities which has built-in security and enterprise scalability. The acxhange solution comprises of multiple components that facilitate the end-to-end processing of incoming documents.

- The “Image/PDF to text” component serves as the inbox for all incoming documents, converting image-based PDFs into text format for further processing.

- The “Classify” component utilizes the power of ChatGPT to extract relevant information from the documents and classify them into different categories or buckets based on their content.

- The “Information Extraction” component handles the second-level extraction, which is tailored to the specific document type. This step focuses on extracting detailed information that is unique to each document category.

- Leveraging the extracted content and designed prompts, we enable the system to take the “next best” action. This decision is based on confidence scores, allowing for the implementation of a fully automated workflow or an assisted workflow that involves human intervention.

With our cutting-edge solution powered by Microsoft Azure OpenAI Service, we’ve achieved outstanding outcomes for a West Coast-based client, significantly alleviating their operations team’s workload. Witnessing a remarkable 100% classification accuracy, our system ensures precise categorization of documents. By seamlessly implementing automated next best actions, we’ve streamlined their work process, leading to an impressive 60% reduction in processing efforts for complex cases like application submissions, cancelations etc. Our solution efficiently handles these tasks through a seamless automated flow, enhancing overall efficiency and productivity.

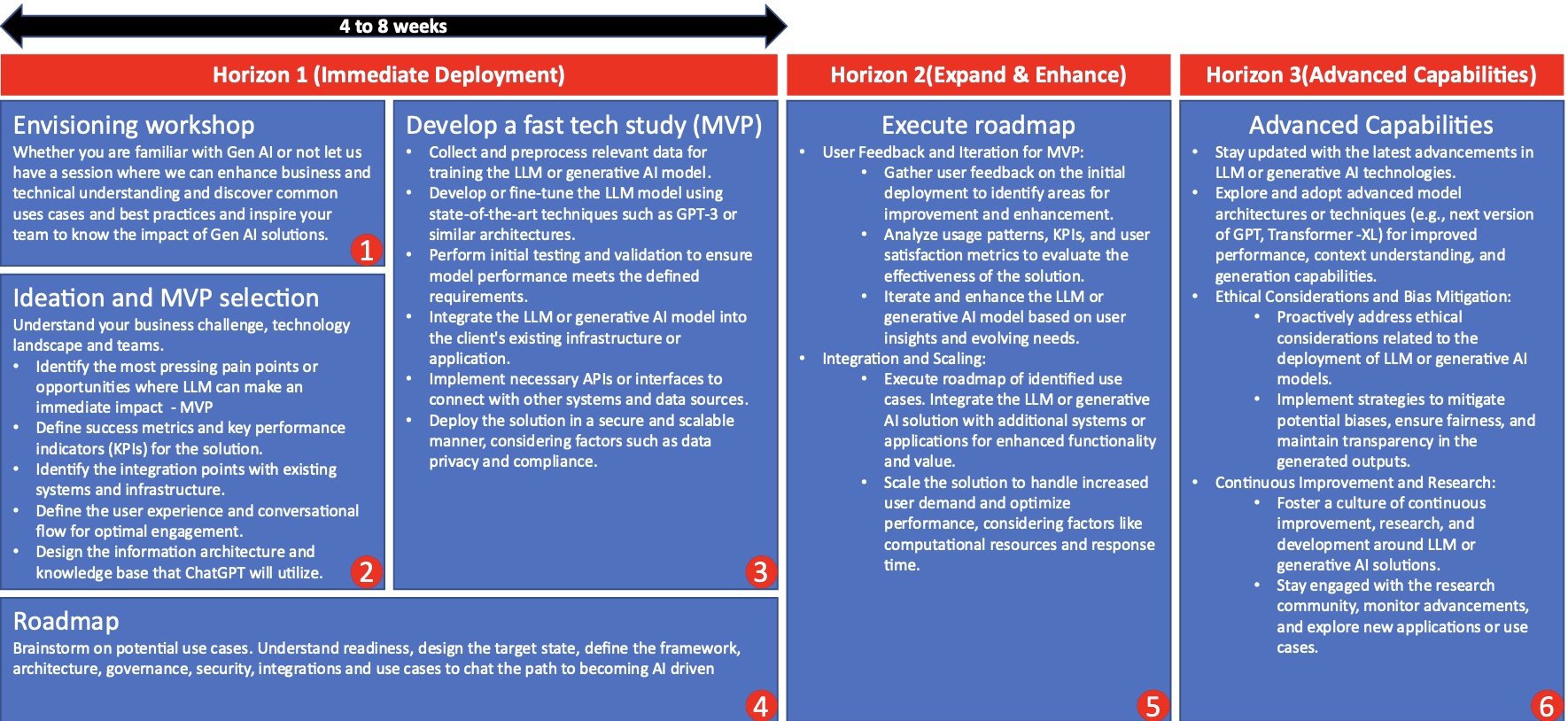

We are committed to delivering tangible results quickly, prioritizing your productivity improvement in a matter of weeks, not months. Our accelerated approach is designed to provide a seamless and efficient transition to Generative AI, offering numerous benefits along the way. Below outline of our approach, which will lead you on a transformative journey towards enhanced efficiency and streamlined processing, reaping rewarding outcomes at each stage.

Our approach is designed to expedite your journey into the world of Generative AI, unlocking its rewards and benefits swiftly. Let us be your trusted guide as we embark on this transformative endeavor together, increasing your efficiency, productivity, and overall operational excellence. If you have any questions, please reach out to us.

Get in Touch

We're here to answer all your queries. Reach out to us to accelerate your business