Unleashing the Power of LLM – Transforming Insurance Experience

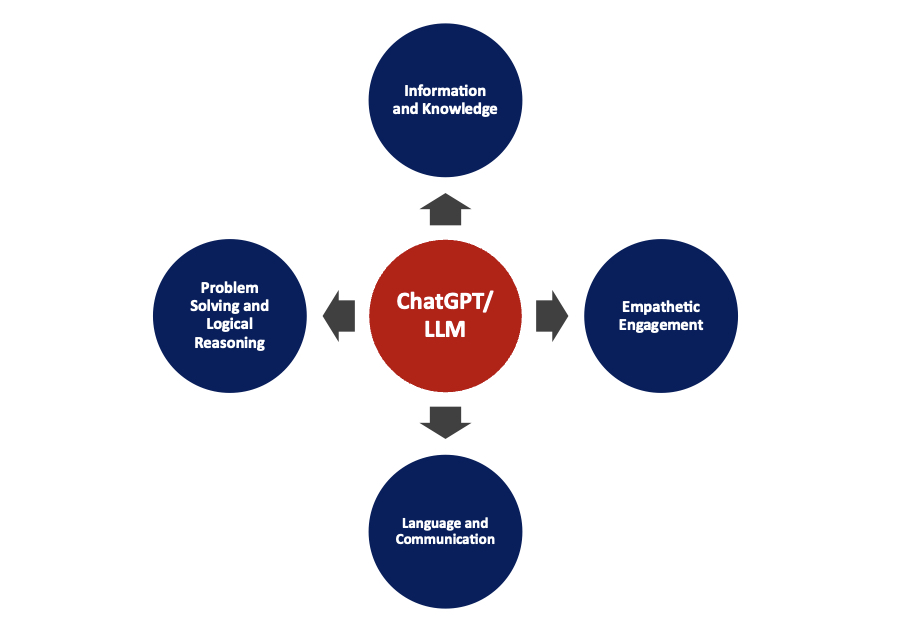

The insurance industry, a sector deeply entrenched in tradition and rigorous processes, is undergoing a rapid digital transformation and staying ahead of the curve is essential. The digital age has ushered in a new era of possibilities, and one of the most exciting advancements is the emergence of Large Language Models (LLM). These powerful AI – driven tools have the potential to revolutionize insurance value chain. Insurers are looking to offer more intuitive, responsive, and personalized experiences. By integrating LLMs across the insurance value chain, insurance carriers can unleash a slew of transformative capabilities – – below some of the specific areas.

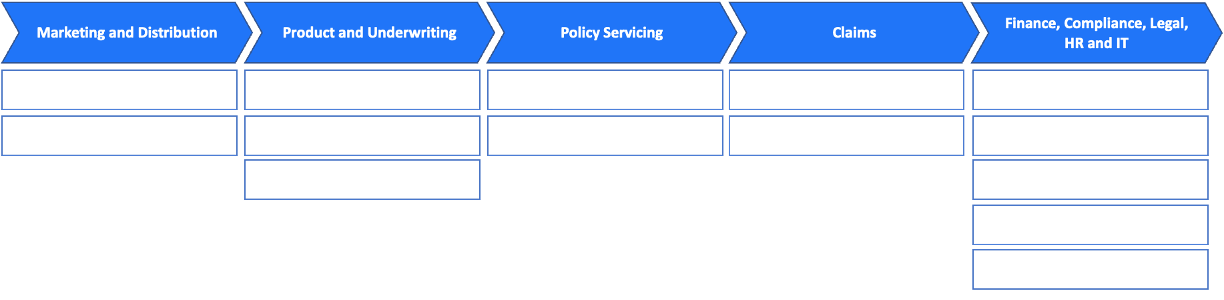

Marketing and Distribution: The early stages of insurance engagement are crucial.

- Content Creation Assistance: In the realm of marketing, crafting compelling personalized content that resonates with the customer base is vital. LLM can analyze market trends, customer feedback, and user behavior to suggest relevant topics. Beyond mere product recommendations, LLM can tailor content based on user preferences, ensuring that marketing materials resonate with the target audience. Also, it can analyze user engagement with content and suggest improvements, such as changing the tone, style, or even the medium (e.g., video vs. text).

- Agent Empowerment – chat with recommendations: Agents, equipped with LLM-driven tools, can receive real-time, personalized recommendations for their clients. This not only enhances the agent’s efficiency but also improves the client’s experience, fostering trust and loyalty.

Product and Underwriting: Creating right product and underwriting, a cornerstone of insurance operations, can be transformed with LLMs.

- Market Analysis: By sifting through vast amounts of unstructured data, LLMs can identify nuanced customer preferences and emerging market trends, allowing for more tailored product offerings.

- Risk Assessment: Automating the extraction of key terms from various documents and social data, LLMs can streamline risk profiling, leading to more accurate and swift underwriting decisions.

- Knowledge Support: LLMs can act as decision-support systems, offering underwriters insights gleaned from vast historical data sets, helping even novice professionals make informed decisions.

Policy Servicing: Effective policy servicing ensures customer retention. Here, LLMs play a pivotal role in:

- Hyper-Personalization: By empowering virtual customer service agents, LLMs ensure customers receive contextually relevant responses in real-time.

- Personalized notification generation: LLMs can curate and produce content that is aligned with the individual needs of customers, enhancing their overall policy management experience.

Claims: The claims process is a critical touchpoint in the insurance customer journey:

- Automated Decision Support: The claims process can be intricate. LLMs can assist by delivering synthesized recommendations, backed by reasoning from document and image analysis to offer actionable insights, streamlining the claims validation process. Furthermore, by harnessing historical context and patterns, AI can provide valuable insights, aiding adjusters in making precise decisions.

- Subrogation and Litigation Analysis: By analyzing litigation documents, LLMs can predict potential outcomes, ensuring the insurer is prepared for varied eventualities.

Finance, Compliance, Legal, HR, and IT: Across these supporting functions, LLMs provide significant enhancements.

- Invoice Reconciliation: LLMs can automate the extraction and cross-referencing of data, ensuring financial accuracy.

- Compliance/Controls: Detecting changes in regulations and suggesting actionable controls, LLMs ensure seamless compliance.

- HR : From candidate screening to onboarding, LLMs can automate and refine HR processes, allowing professionals to focus on strategic initiatives.

- Legal : Legal teams often wade through vast amounts of documentation. AI can facilitate contract analysis, highlighting key terms and potential areas of concern. Moreover, it can streamline legal research by quickly sifting through case laws, statutes, and precedents to provide relevant information.

- IT : LLMs can aid in code analysis, bug identification, and even system optimization suggestions, ensuring the IT infrastructure remains robust.

The future of insurance is here, and it’s powered by the capabilities of Large Language Models. Incorporating Large Language Models across the insurance value chain not only streamlines processes but also reinvents the way insurers engage with their customers and employees. By leveraging the capabilities of LLMs, insurance companies can ensure a future that is data-driven, personalized, and above all, customer-centric. This transformative approach promises not just enhanced operational efficiency but also a competitive edge in an increasingly digital world. Embrace this technological innovation to simplify policy understanding, receive personalized recommendations, streamline claims processing, and stay prepared for emerging risks.

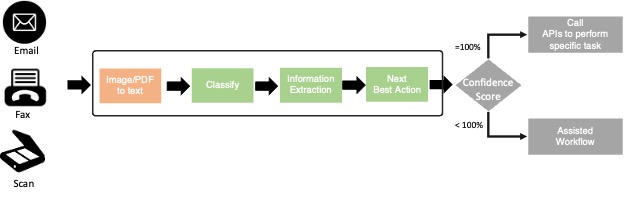

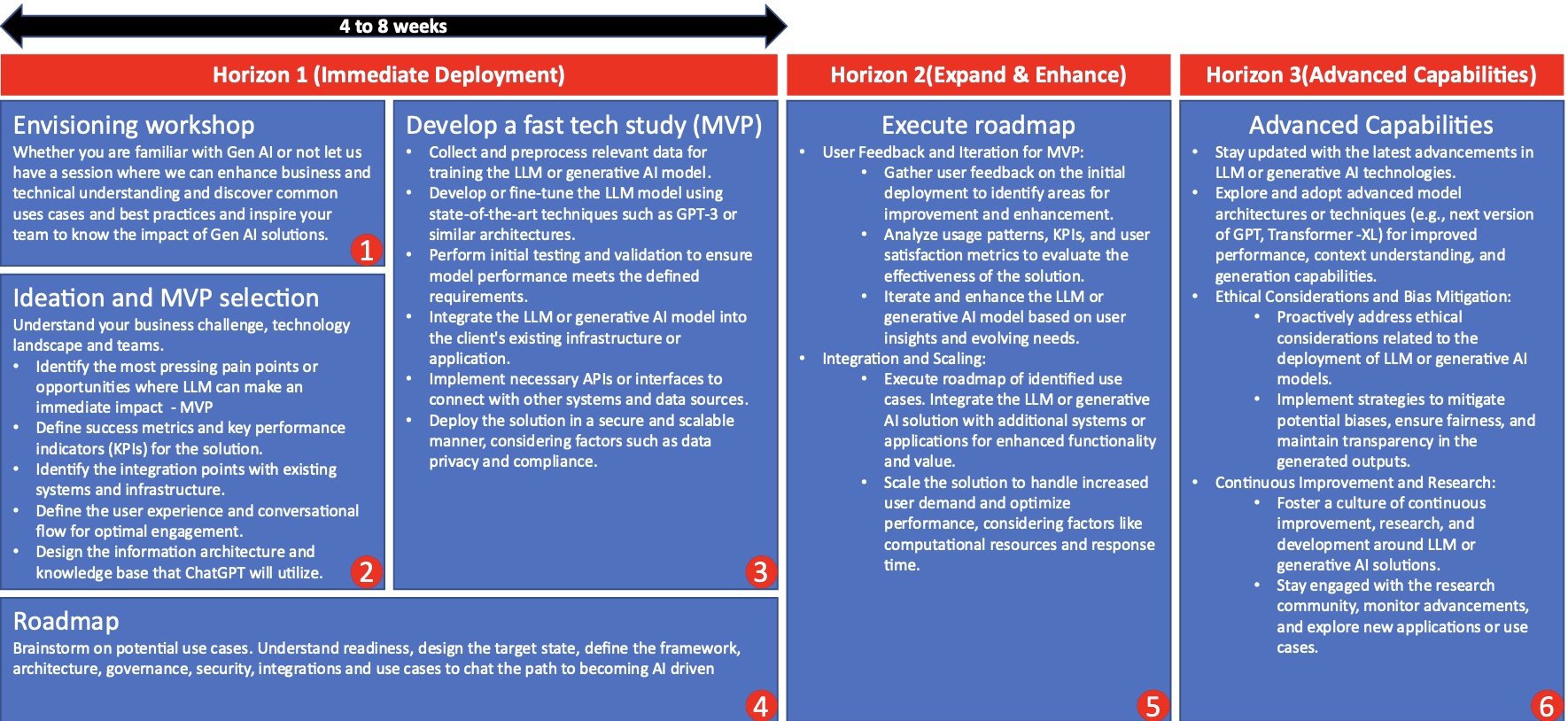

Call to Action – Ready to unlock the potential of Large Language Models for your insurance journey? Understanding the potential of Large Language Models in reshaping the insurance landscape is one thing, but effectively integrating them into your business operations is another. Whether you’re curious about starting this transformative journey or ready to delve deep into its applications, we’re here to work with you collaboratively every step of the way. Our team specializes in LLM implementation across the insurance value chain. We have an approach (see below) and solutions to expedite your journey into the world of LLM/Generative AI, unlocking its rewards and benefits swiftly. Let us be your trusted guide as we embark on this transformative endeavor together, increasing your efficiency, productivity, and overall operational excellence.

Get in Touch

We're here to answer all your queries. Reach out to us to accelerate your business